Call us for your Enquiries :

SAP FICO Training in Chennai

Post Purchase Invoice Using FB60 in SAP?

How to Post a purchase invoice Using FB60 in SAP?

How to create a vendor invoice Using FB60 in SAP?

Automatic Posting for Tax Calculation amount Using FB60 in SAP?

Tax amount calculation in FB60?

Tax calculation on base amount in FB60?

calculating Automatically withholding tax Using FB60 in SAP?

Automatic calculate withholding tax in FB60?

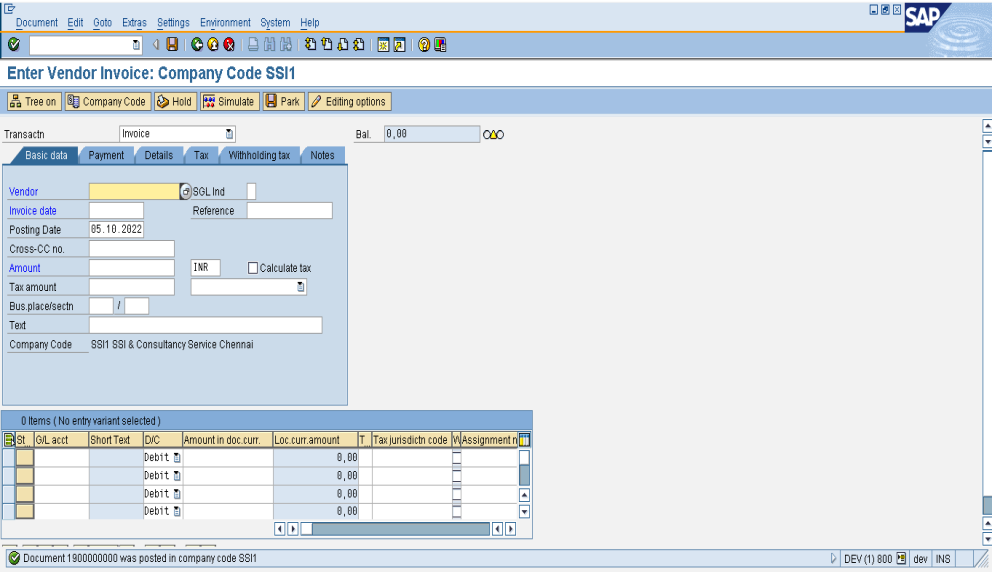

Enter Vendor Invoice FB60

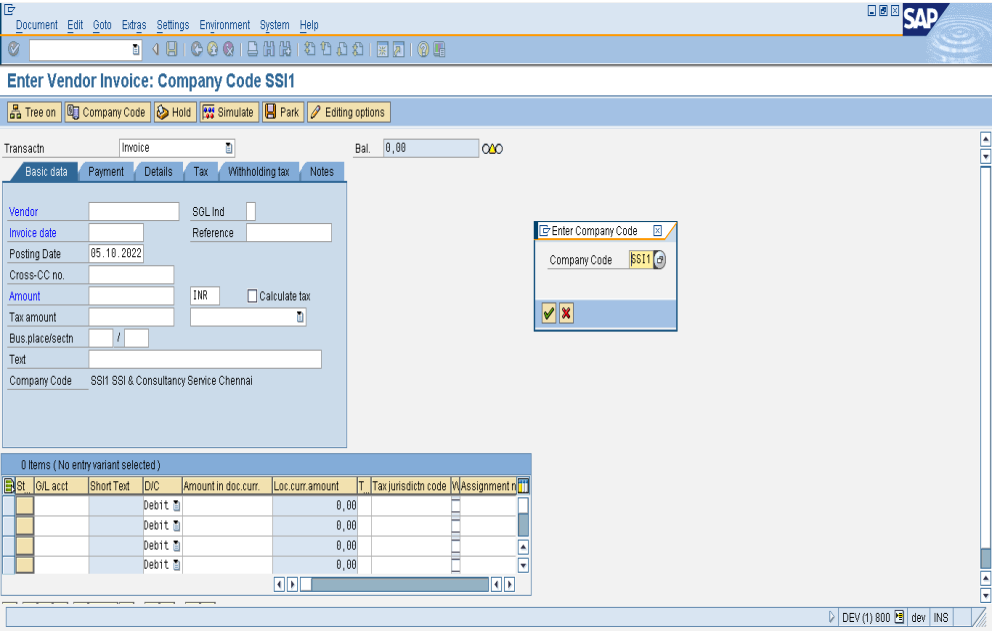

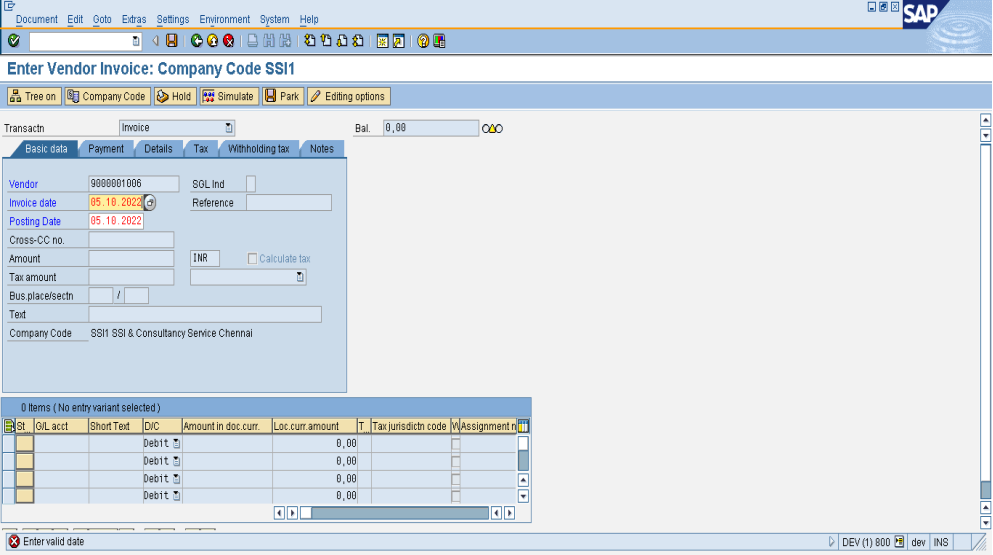

Enter FB60 in the Command Prompt and press Enter Key. Click company code enter the company code created and press enter key.

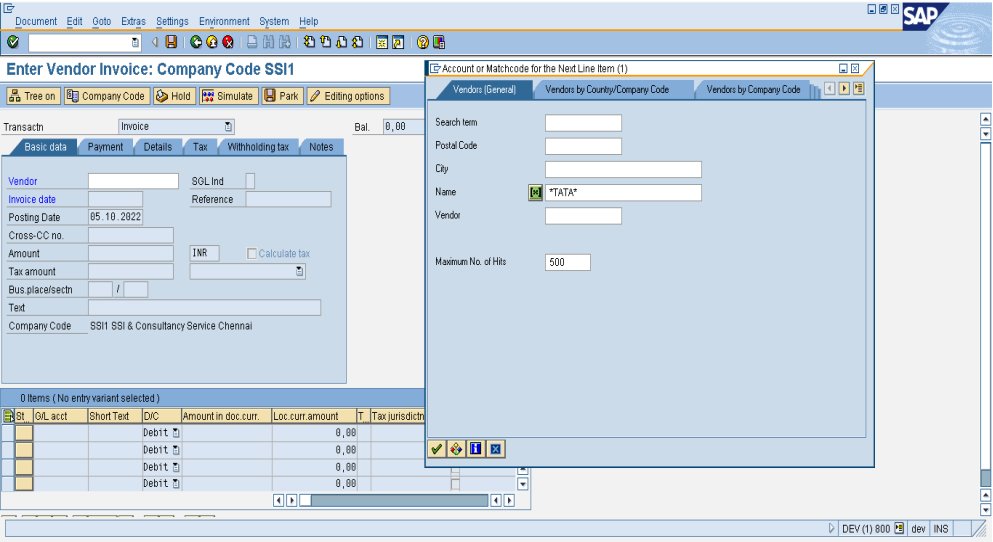

Click search button in vendor, to search the vendor code Go to name and enter *vendorname* and press enter key.

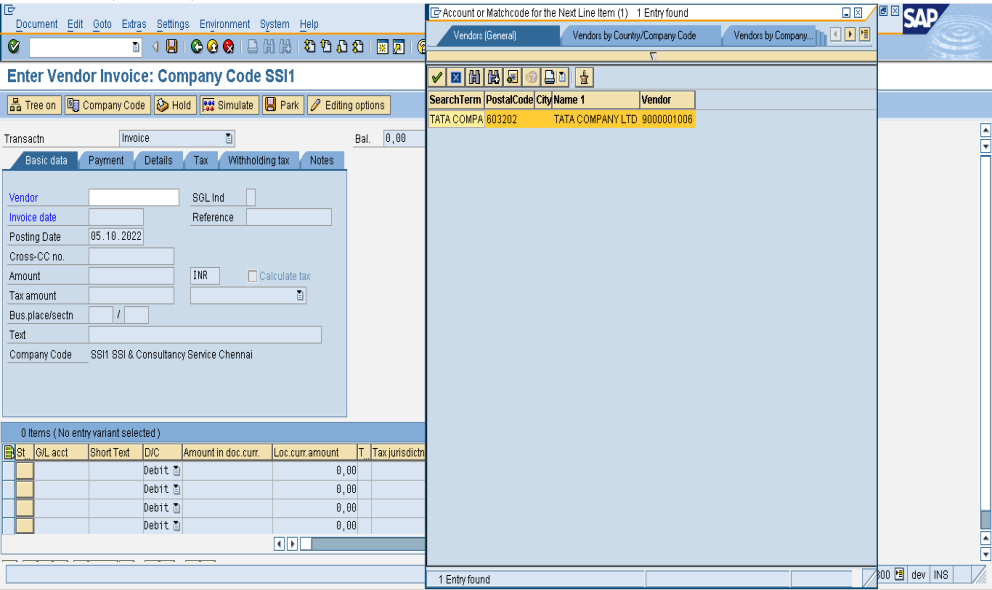

Press enter key to select the vendor code.

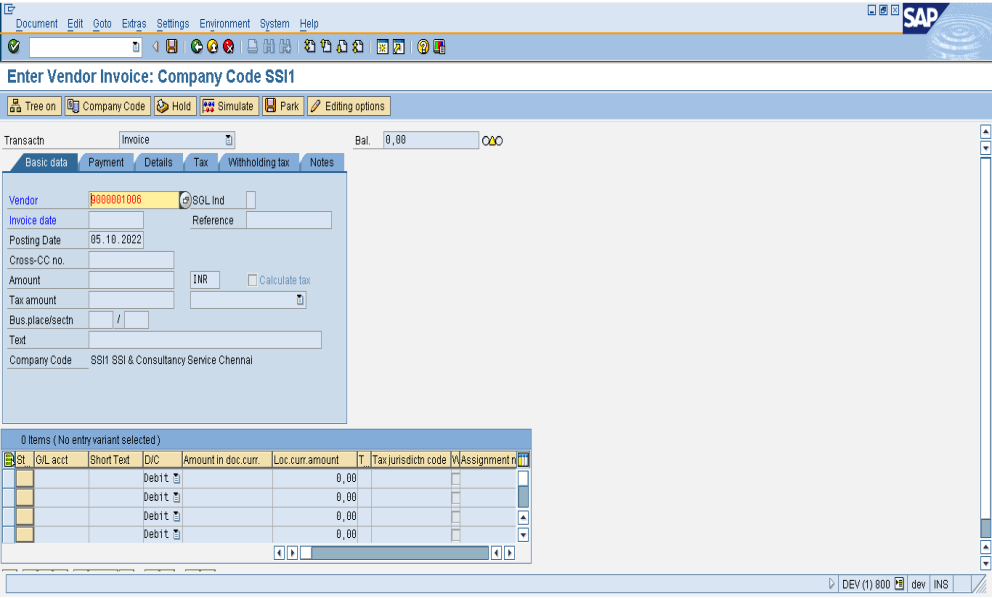

Since the below screen in disable mode press enter key once again.

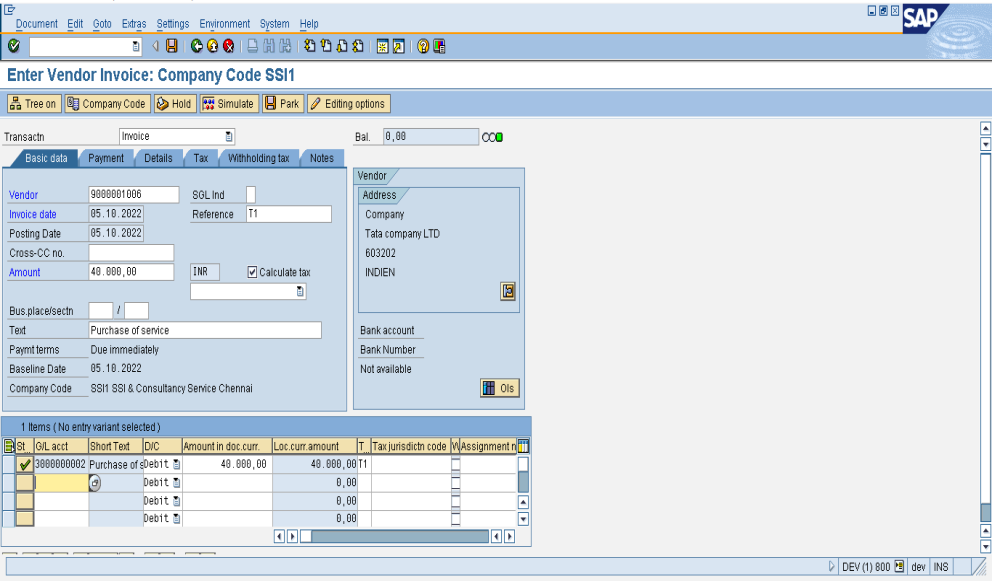

Enter the invoice date and press enter key.

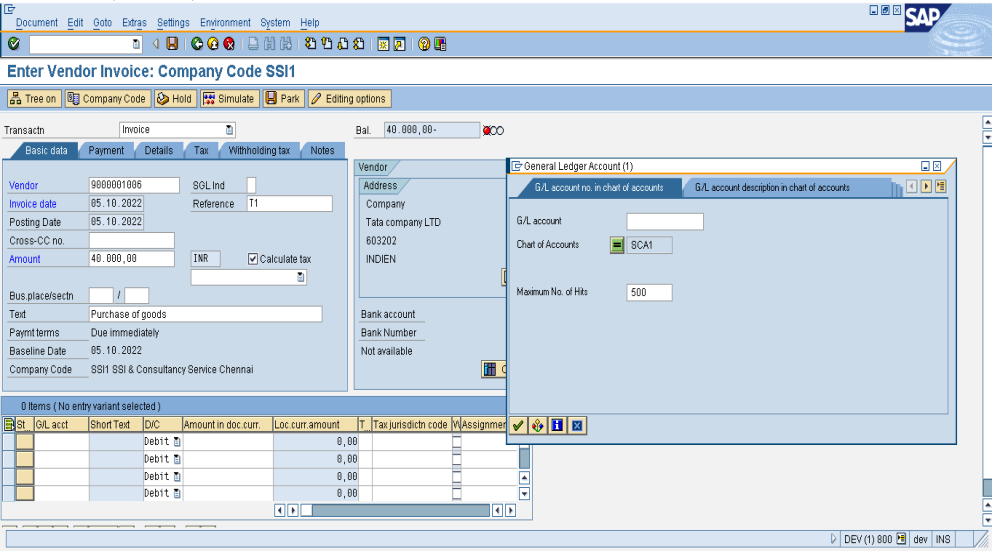

The vendor code is selected, invoice date is entered, posting date selected default, Enter the Reference number, amount. And tick calculate tax for auto calculation (GST) and enter the text (Narration) for the transactions. And go to GL account click search button the chart of account automatically appear due to assigned with company code and press enter key.

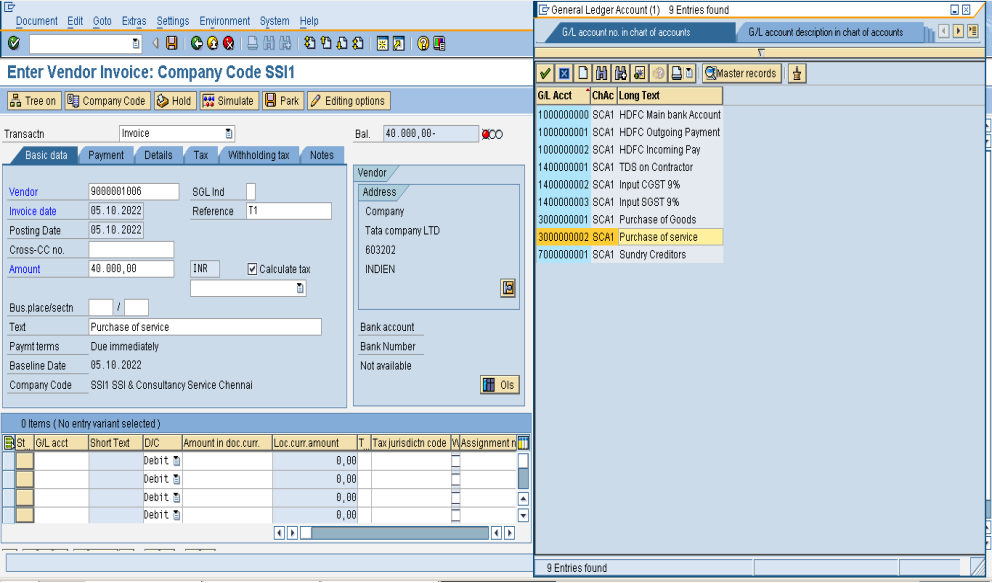

Select the GL account for the transaction.

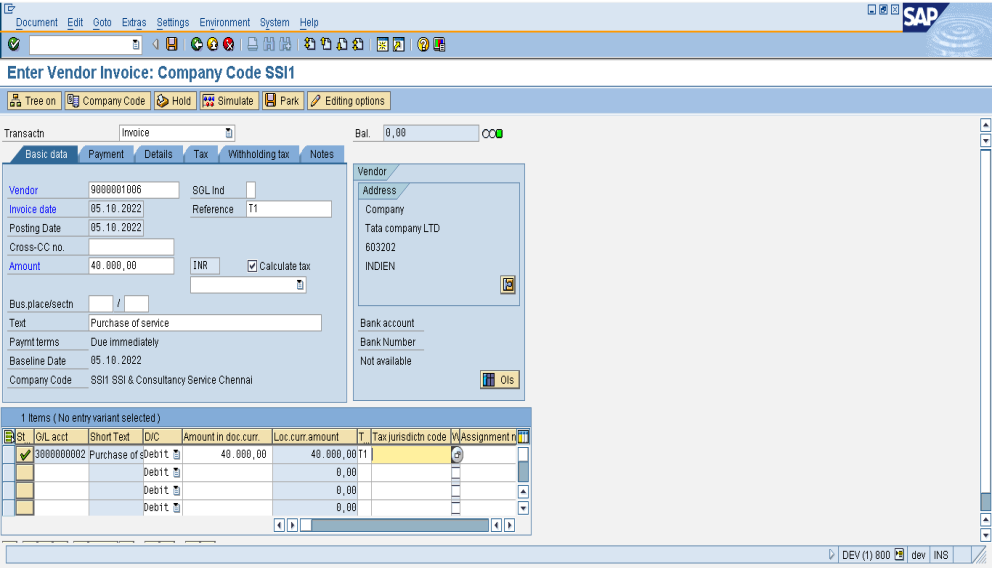

GL Account is selected, enter the amount and press enter key. Automatically Short text will be appeared for the GL account and TAX code will appear for the same GL account. Click simulate to display the entry.

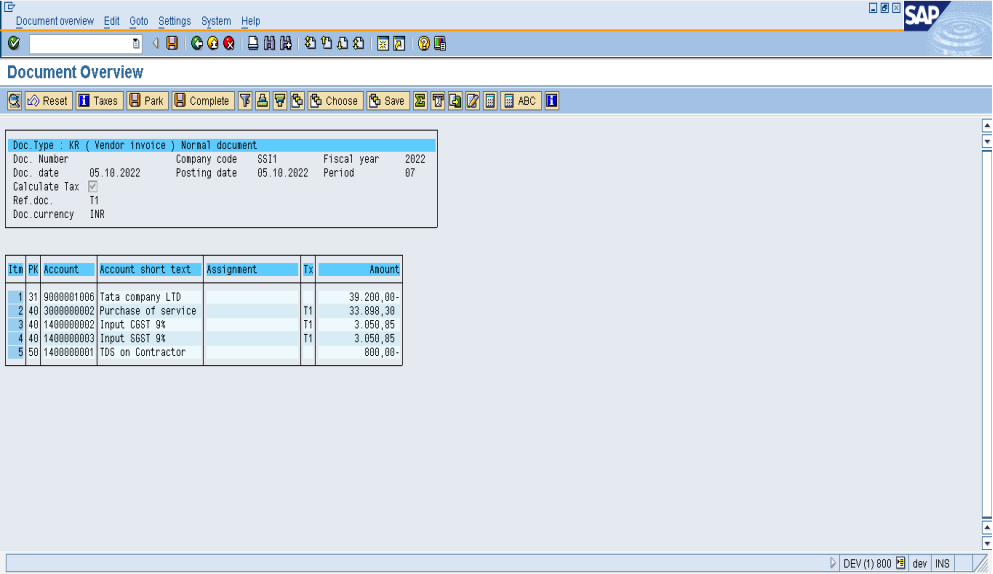

TDS is calculated on whole amount so click back button.

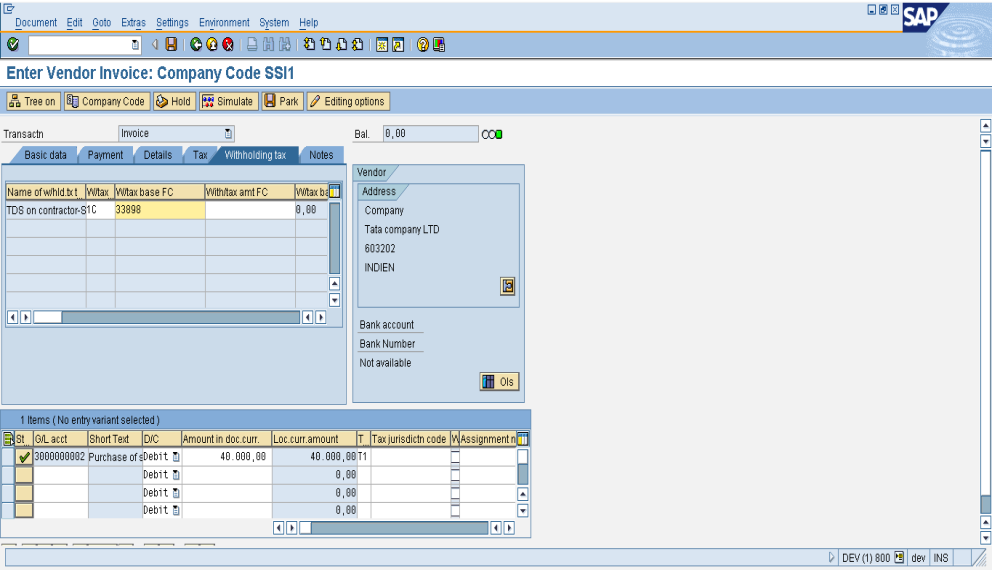

Click withholding tax.

Enter the base amount excluding GST and click stimulate

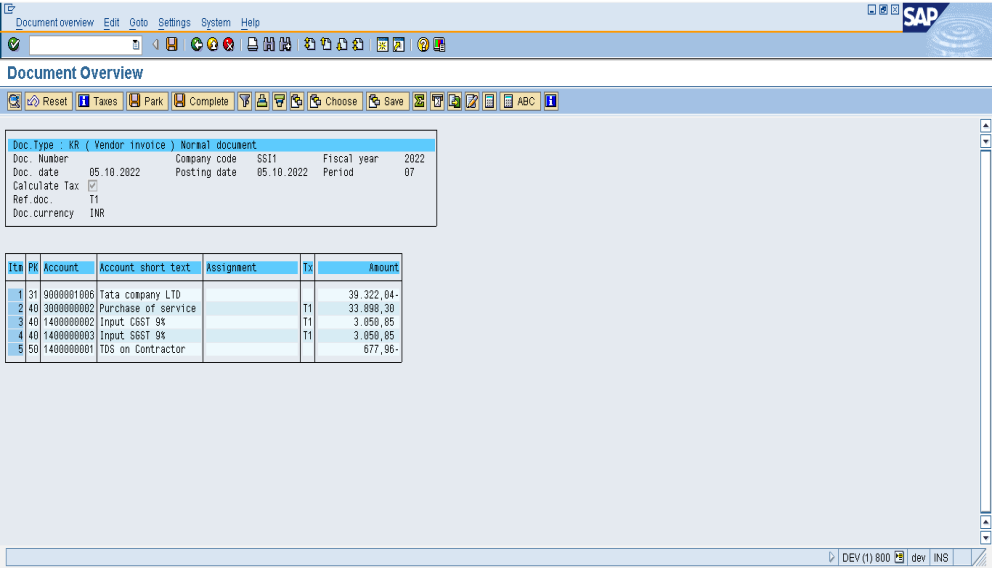

SAVE the entry.

Document is saved.

© Copyright 2023 Witty Technologies. All Rights Reserved.

Designed by Spider India